Kicking off our move to Nigeria with bang, we started the year with a cash crisis. In February/March of this year, there was a move from the government to transition out all old Naira notes in favor of a new Naira note. Unfortunately, there was not enough of the new Naira available which caused a shortage when people were trying to exchange their notes, long long lines at ATMs, and a meaningful decrease in consumer spending because people just didn’t have cash to buy things. This particular crisis is now resolved, but was a telling indicator of how complicated money and payments are in Nigeria.

The biggest change from my typical understanding of currencies is that the official exchange rate that you might find on Google is not reliable - Nigeria has a complicated exchange rate system that essentially establishes an official exchange rate (what you’ll see on Google) and an unofficial, “parallel” or black market rate. The Central Bank of Nigeria sets the official exchange rate, but everything you buy as a consumer is priced according to the parallel rate, and there are a variety of mechanisms to buy Naira at the parallel as an individual consumer. If anyone has visited Argentina, it has a similar dual exchange rate and you likely had a similar experience there. There are a whole host of business implications for this, and recently the CBN has actually significantly devalued the Naira and made the official rate much more comparable to the parallel rate, which should be a long-term good move. But that’s a story for another day!

Because of this, even in places that theoretically could accept a foreign credit card (though this is already nearly nonexistent), you’d receive the official rate which is a Bad Deal™️. This also means that if anyone wants to come visit us, your trip ends up being sponsored by Dave because of your actual inability to pay for things - a real perk!

So, as a newbie, you’re stuck either having your friends pay for you, or carrying around wads of cash because the largest Naira note is NGN1000, the equivalent of about $1.25.

Once you get yourself situated with a bank account though, you realize that the payment infrastructures are in some ways much more advanced than the US. Bank transfers are extremely widely used, including the ability to pay merchants with a bank transfer that goes through immediately. Compared to bank transfers in the US that take 3-5 days, the immediacy of transfers here was a welcome surprise. Private solutions like Venmo, PayPal etc have obviously popped up in the US to solve this immediacy problem, but aren’t widely used in businesses.

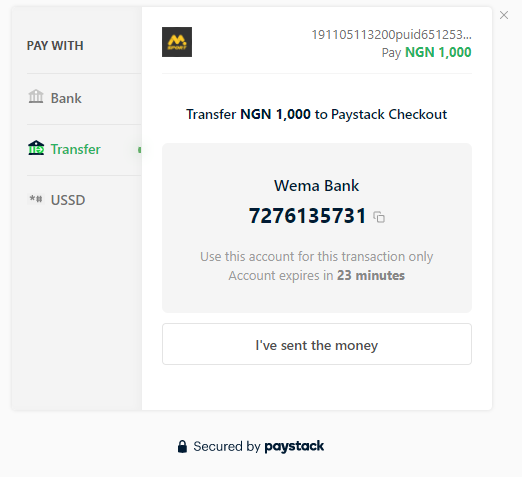

Paystack, a fintech player that was recently acquired by Stripe, has built a pretty amazing payment infrastructure for online payments with bank transfers. When you go to pay an online vendor with transfer, Paystack auto-generates temporary account information for the vendor that is expecting the specific value of the transaction. Once you transfer the money it verifies that you’ve sent the specific amount and confirms the order. As a product person, I absolutely loved this solution.

Of course, many poorer people here are still unbanked, which could mean that implementing a solution like M-Pesa, available in Kenya and other parts of Africa, could still be an even better solution. M-Pesa allows users to load money directly onto the SIM card of their mobile phone and store and transfer money that way without having to have a traditional bank account. It’s not yet available in Nigeria, but is something to look forward to!

Bonus Feature: One other feature I love here is that the handheld payment terminals are primarily digital, and they reorder the numbers on the pinpad every time you type in your pin so that a nearby observer is less able to figure out your pin by looking over your shoulder.